![]()

Index Page

|

|

Index Page

|

Payroll Management Software for Windows

EMPLOYEE

This function stores HR and Payroll details of the Employees. Employees can be added here only if the employee’s resume has been entered in HR – Masters – Resume option and has undergone interview & approved for admission in HR – Masters – Interviews.ADD RECORD

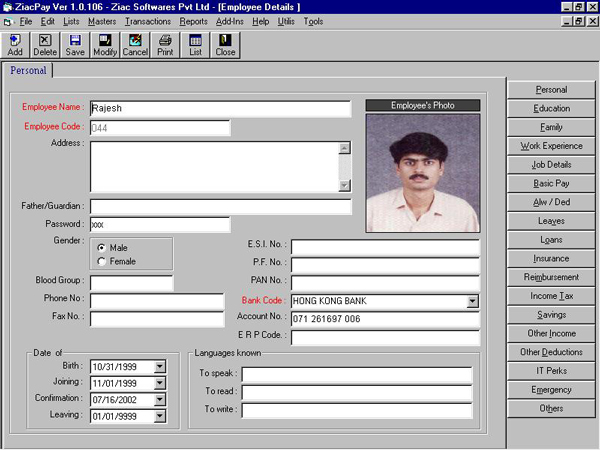

Employees – Personal

Employee Name:

A drop down list displays the names of the candidates selected in the Interview by the selection committee. If an employee details has to be added then first the employee resume has to be fed and then undergo through an interview and finally approved by the General Manger for recruitment. When a candidate is selected as a new employee, most of the resume details such as candidate's education, family, personal and work experience is updated, however the same can also be modified.

Employee Code:

Employee code number allotted by the company to the employee has to be fed here, this will remain unique for the company. The same number cannot be allotted to other employee even after the current employee has left the services of the company. This code is alpha numeric with a maximum length of 20 characters.

Photo:

Double click on the photo frame to select the file in which the employee photo is stored. The user is prompted to select the path in which the photo file is stored, the photo can be in the .bmp (bitmap) or .jpg (JPEG) format.

Address:

The present address of the employee, which by default is picked up from the employee's resume.

Phone:

Employee Phone number which is by default picked up from the resume

Fax No.

Employee Fax number which is by default picked up from the resume

Blood Group:

Blood group of the employee to be keyed in here

Gender:

Select the radio button whichever is applicable to the employee

Date of Birth:

Date of Birth of the Employee, enter in dd-mm-yyyy format

Date of Joining:

Date of Joining the Company, enter in dd-mm-yyyy format

Date of Confirmation:

Date of Confirmation of the employee

Date of Leaving:

Date of leaving of the Employee. Once this date has been mentioned the software considers the employee as an ex-employee and does not generate any pay slip for the same. This field cannot be empty, if date of leaving is not know, key in 01/01/9999.

E S I No.:

Employee ESI No. allotted by the company

P F No.:

Employee PF Number allotted to the employee by the company.

P A N No.:

Employee's Permanent Account Number of the Income Tax

Bank Name:

This dropdown list of banks in which the employee owns an account

Bank Account No.:

Bank Account Number of the employee in the bank name earlier selected.

Languages Known:

The list of languages the employee knows to Speak, Read and write.

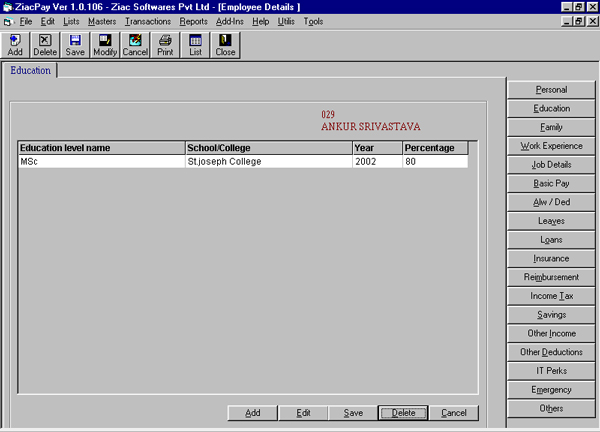

Employees – Education

The employee education background, these details by default are picked up from the resume option whenever a new employee is added.

Education Level:

A dropdown field which lists the different classes/education levels.

School/College Name:

The Name of the College/School in which the employee studied during the corresponding education level.

Year:

The year in which the employee completed the corresponding education level.

Percentage:

Percentage obtained by the employee in the corresponding education level.

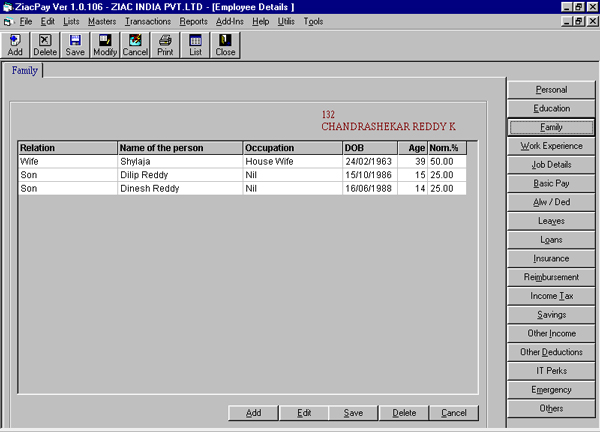

Employee – Family

The employee Family background, these details by default are picked up from the resume option when ever a new employee is added.

Relation:

A dropdown field lists the different relations. The relation name on how the person mentioned is related to the employee.

Name of the Person:

The Name of the person whose relation is selected.

Occupation:

A dropdown field, which

lists the different occupations and the current occupation of the person mentioned, is to

be selected.

Percentage:

This family details also forms as the nomination declaration. The employee can declare the percentage applicable to different family members.

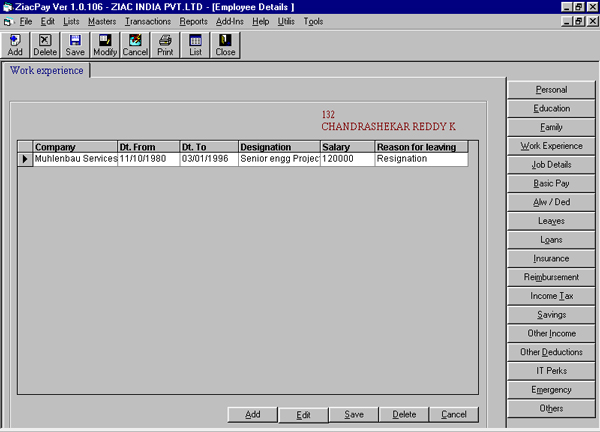

Employee – Work Experience

Previous work experience of the employee is stored here. This by default is picked up from the resume of the employee.

Company Name:

The names of the company where the employee worked earlier

From:

The date from which the employee worked for the corresponding company

To:

The date to which the employee worked for the corresponding company

Designation:

The designation as which the employee worked for the corresponding company

Salary:

Salary drawing during his tenure in the corresponding company

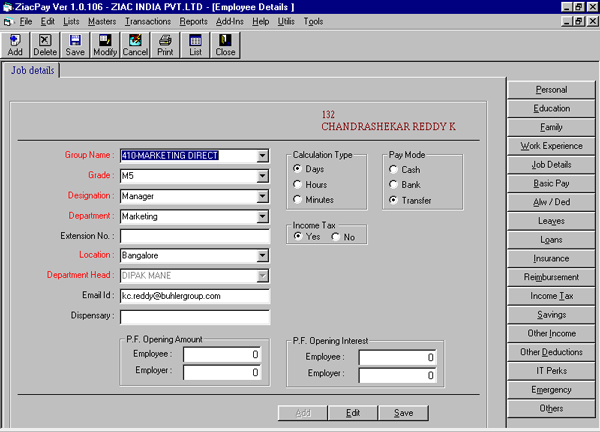

Employee – Job Details

The job details of the employee like the employee group, designation, department etc.

Group:

This dropdown field lists all the employee groups available, the user has to select the particular employee group for the employee from the list. Based on this group the group pay structures will be applicable to this employee, however this can be changed in the Allowances/Deductions. Make sure the Groups have been filled in the Masters Menu.

Grade:

This dropdown field lists all the employee grades available, the user has to select one from the grades list for the employee. Make sure the Grades have been filled in the Masters Menu.

Designation:

This dropdown field lists all the designations available, the user has to select one from the designations list for the employee. Make sure the Designations have been filled in the Masters Menu.

Department

This dropdown field lists

all the departments available, the user has to select one from the departments list for

the employee. Make sure the Departments have been filled in the Masters Menu.

Location:

This dropdown field lists all the locations available, the user has to select one from the location lists for the employee. Make sure the Locations have been filled in the Masters Menu.

Superior:

This dropdown field lists all the employees in company, the user has to select the immediate superior employee for the employee being entered.

Email ID.:

Employee internal E-mail ID. This will be helpful for mailing reports to the employee.

Dispensary Name:

The ESI dispensary to which the employee is attached.

Calculation:

The type of salary calculation based on Days worked, Hours worked or Minutes worked for the month.

Payment Mode:

The salary to an employee can be paid in three modes,

Cash : Nett salary paid to the employee by cash

Bank : Nett salary Cheque issued to the employee

Transfer: Nett salary transferred to the employee bank account

A report is generated with the employee names and their net salary grouped on the payment modes.

Income Tax:

If Yes radio button is selected then the Income Tax for the employee is automatically calculated by the software.

Overtime:

Over Time Salary per hour for the employee. This will also be used by the job costing module.

Nett Salary:

Nett Salary of the employee.

PF Opening Balance:

Provident Fund opening balance amount has to be fed initially, this amount will be updated as and when the payslips are generated.

PF Interest Balance:

Provident Fund opening balance of the interest amount has to be fed. This value has to be updated manually yearly.

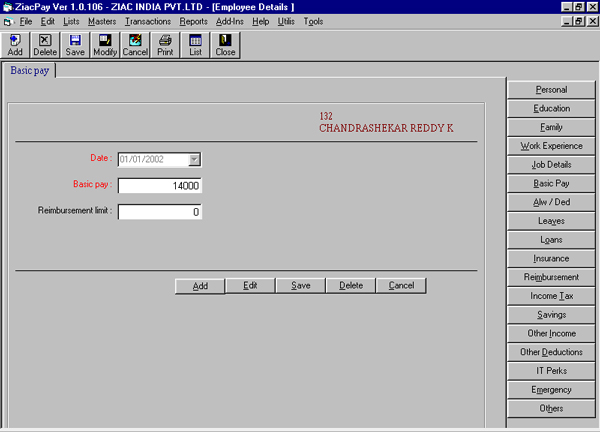

Employees – Basic Pay

Date:

The effective date on which the Basic Pay for the employee is changed.

Basic Pay:

Basic Pay value of the Employee

Reimbursement:

Maximum amount of Reimbursement eligible to the employee, based on the calendar year / financial year.

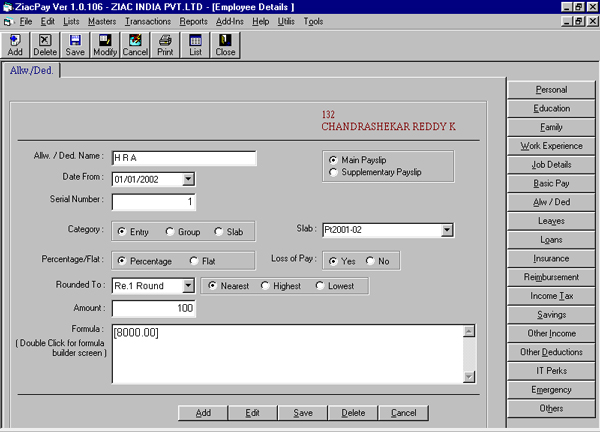

Employees – Allowances / Deductions

Allowances/Deduction Name:

A dropdown list of the Allowances/Deductions from which the user has to select the Allowance/Deduction name associated to the employee.

Date:

The effective date from which the Allowance/Deduction is associated to the employee.

Main/Supplementary:

The Allowance/Deduction is part of the Main or Supplementary Payslip.

Category:

If the category selected is Entry then the related information of the Allowance/Deduction has to be fed here. If category is group/slab the Allowance/Deduction will to be referred to the corresponding group/slab structure.

Percentage/Flat:

Whether the Allowance/Deduction selected is calculated on percentage basis or flat amount.

Loss of Pay:

Loss of Pay is applicable to the Allowance/Deduction name selected.

Round Off:

In case of Loss of Pay then the value calculated can be rounded off. The user has to select from this dropdown field, the rounding off ranges from 5 paise to Rs.10/–.

Nearest/Highest/Lowest:

The user has to select any one from the radio buttons to indicate the slab value to round off to Nearest/Highest/Lowest of the Round Off value selected earlier. If the slab amount is 58.45 and

Example:

Slab Result Value 58.43

Round Off Selected Rs.1/–

Nearest 58.00

Highest 59.00

Lowest 58.00

Amount:

The value entered in this field is considered as flat value for the allowance/deduction selected. If percentage is selected then the amount corresponds to the percentage of the formula.

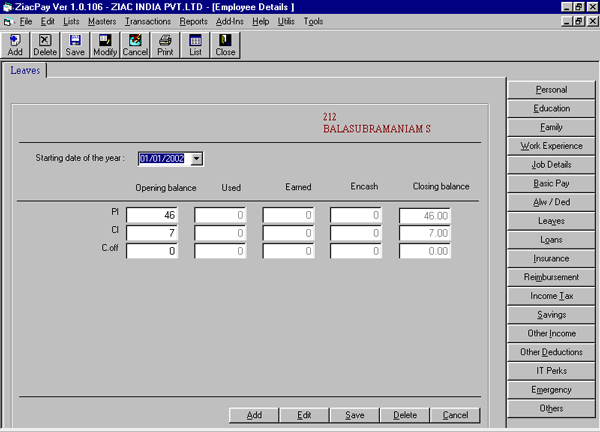

Employees – Leaves

Date:

The effective date from which the leaves mentioned are applicable to the employee.

Leave Name:

The software lists all the leave names mentioned in the Payroll Setup. Only active leave names are listed. Leave names which are not enabled means they are not applicable to a particular gender.

Opening Balance:

The user has to key in the opening balances of the leaves applicable to the employee. This has to be done only while defining the employee leaves or yearly.

Used:

The used leaves are automatically updated when the payslips are generated. The user does not have access to this field.

Balance:

The balance leave is the difference of opening leaves and used leaves. This is also automatically updated by the software. The user does not have access to this field.

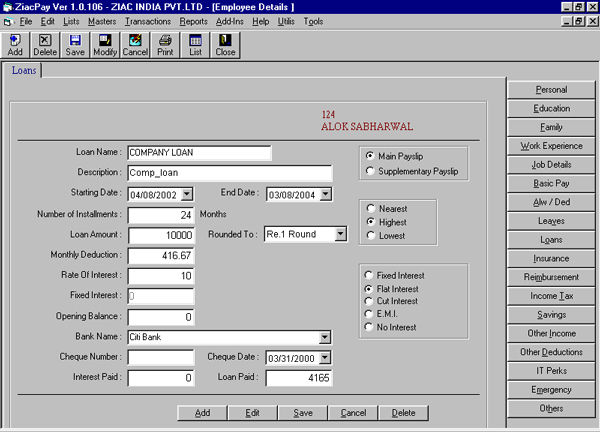

Employees – Loans

Loan Name:

A dropdown field from which the loan name is to be selected.

Description:

The description of the loan name

Main/Supplementary:

Whether the Loan has to be deducted in the Main or Supplementary Payslip

Starting Date:

The starting date of the loan

Ending Date:

The Date on which the loan ends

Installments:

Number of installments for the loan

Loan Amount:

Total value of the Loan sanctioned

Interest Type:

The type of Interest, Flat, Diminishing, EMI etc.

Rate of Interest:

Percentage of interest applicable yearly

Monthly Deduction:

By default the software calculates the monthly deduction of loan value, however the user can change the value calculated.

Opening Balance:

Opening balance of the loan amount. All new loans will have zero as opening balance, in case of old loans where part payments have already been deducted the opening balance has to be mentioned.

Bank Name

The name of the bank on which the loan has been issued.

Cheque No.:

The Cheque leaf number of the loan issued

Cheque Date:

The Cheque issued date

Interest Paid:

Interest amount collected from the loan amount. By default the software calculates the interest amount and adds up to this field.

Loan Paid:

This field keeps the updated value of the total loan paid till date.

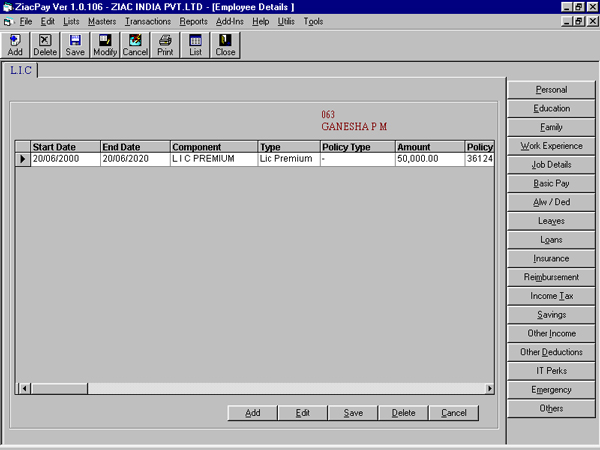

Employees – LIC

Details of the Life Insurance policies of the employee are stored here, which will be used to automatically deduct from the Employee Payslip. |

Start Date & End Date |

Starting

and Ending date of the LIC policy

|

Policy Type: |

The

type of LIC policy, endowment, money return etc.

|

| Amount: |

| Total

Amount of the Insurance |

| Policy Number: |

| Insurance

policy number |

Premium: |

Monthly Premium of the LIC |

Employees

– Reimbursement